FIRST-TIME HOME BUYER

If you're purchasing your first home or haven’t owned one in three years, you're able to take advantage of our first-time home buyer loan.

Ready to get started? Apply online, call us at (800) 533-0035, Option 3, or use our contact form.

Apply now

Buying a home for the first time is a daunting process. To aid you on the steps of your journey — from determining your budget to walking away with the keys to your house — our team is here every step of the way. You'll find a variety of resources, such as a glossary of industry lingo, detailed checklists, realtor recommendations, planning calculators and webinars with loan experts.

Don't know where to start?

Our mortgage specialists would love to answer any of your home loan questions. Call us at (800) 533-0035, Option 3, or use our contact form.

First-Time Home Buyer Overview

As a first-time home buyer,* you'll have the option to pick a fixed- or adjustable-rate mortgage that will best meet your needs. Our mortgage loan experts can guide you in the process of making your choice.

Benefits of the first-time home buyer loan:

Special Discounted Rate: Your loan rate is lower than most other mortgages. See our rates for more details.

Lower Closing Costs: We'll refund your processing fee after you close.

Low Down Payment Options: You can even use funds given to you from a family member to help with your down payment.

In-House Servicing: You'll always be able to contact us with any questions during the life of your loan.

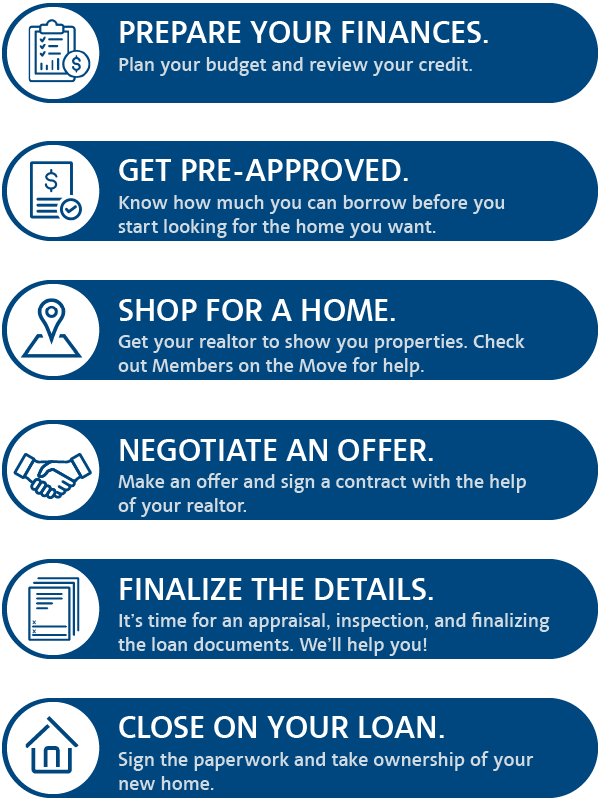

YOUR HOME IS JUST A FEW STEPS AWAY.

1. Prepare your finances. When getting ready to buy a home, it's important to review your credit using our Credit Score and Report feature in online banking. Check your budget with our calculators to see how much home you can afford or how much your mortgage payments could be.

Learn more about what to do before you apply.

2. Get pre-approved. Getting pre-approved before you select your home will help you determine how much you can finance. A pre-approval makes your loan process faster and also signals your realtor that you're a serious buyer.

Get our checklist for all the details on what documents you'll need.

3. Shop for a home. Need help finding a realtor? The Members on the Move program is a complimentary service where you can work with a Real Estate Coordinator throughout your home-buying experience.

4. Negotiate a contract. Work with your realtor to make an offer for the home you've chosen.

5. Finalize the details. Your loan team will help you coordinate timing and the payments for inspection, appraisal and insurance.

6. Close on your loan. At closing, you'll finalize all your papework, transfer all down payments and obtain the keys to your home.

MORTGAGE FAQ

We only offer conventional loans; however, depending on your credit score you could qualify to put down as little as 3%. View our rates for more details. A loan officer will be happy to discuss your exact situation with you.

When an Adjustable-Rate Mortgage (ARM) is listed with a slashed set of numbers, the first number is how many years the initial rate will be fixed and the second number is how often the rate can change per year once the fixed term ends.

Example: A 5/1 ARM has a fixed rate for the first five years. After that, the rate is variable and may "adjust" once each year.

Pre-qualification is an initial step in the mortgage process where a lender gives you a rough estimate of how much you might be able to borrow based on basic financial information you provide — like your income, debts, and assets. It’s quick, often informal, and doesn’t involve a credit check or document verification.

Pre-approval, on the other hand, is a more thorough process. It involves submitting financial documents (like tax returns, pay stubs, and bank statements), undergoing a credit check, and having a lender formally assess your financial situation. This results in a conditional commitment for a specific loan amount. A pre-approval makes your loan process faster and also signals your realtor that you're a serious buyer.

Conventional single-family homes require a down payment of as little as 3% for well-qualified borrowers. Condos, manufactered homes and co-ops require as little as 5% for well-qualified borrowers. Members with limited credit history or credit challenges may need up to a 20% down payment. View our rates for more details. Call us at (800) 533-0035, Option 3, or use our contact form to speak with a Mortgage Specialist.

Yes. However, if funds are given to you by another person to help with your down payment, your loan officer will provide a form for them to sign that says the money is a gift and not a loan.

Points are paid as part of your closing costs as a way to lower your interest rate. You pay some of your interest up front in order to save on interest over the longer term of your mortgage.

PMI is required if you put less than 20% down on your home. This extra insurance protects the lender in the event that you stop making your mortgage payments. Costs vary but the Credit Union typically offers it lower than other financial institutions.

Escrow refers to an account your lender uses to hold funds for property taxes and homeowners insurance. Each month, a portion of your mortgage payment goes into this escrow account, and your lender pays those bills on your behalf when they’re due. This helps ensure those critical expenses are paid on time and protects both you and the lender.

Home loans for every need

You find the home. We'll help with the financing.

Fixed-Rate Mortgage

This is the most common mortgage with set monthly payments for 15 or 30 years.

Who's it for: This is ideal for home buyers who plan to stay in their house for a long period of time and prefer a regular, fixed monthly payment.

Advantages: Principle and interest payments stay the same throughout the life of the mortgage (taxes and insurance might fluctuate). There are no prepayment penalties for paying off the mortgage.

Things to know: The rate does not change no matter how the market fluctuates.

Calculate the payments for a 15- vs. 30-year fixed mortgage.

Apply now.Adjustable-Rate Mortgage (ARM)

When you open an ARM, you choose a product based on how long you want your rate to be fixed. There are options to have the rate fixed for 5, 7 or 10 years, and then your payment and rate may be adjusted annually based on current market conditions. For example, a 5/1 ARM has a fixed rate for five years.

Who's it for: Home buyers who plan to stay in their home for only a few years, or are willing to accept the possiblity of a rate change might consider this option.

Advantages: Typically an ARM has a lower fixed rate for the first 5, 7 or 10 years, depending on the product.

Things to know: Your payment and rate may change annually after the initial fixed-rate term.

Calculate the difference between a fixed- vs. adjustable-rate mortgage.

Apply now.Jumbo Mortgages

Jumbo mortgages are the same fixed- or adjustable-rate products, but with a higher minimum loan amount. These loans typically receive a slightly lower rate.

- Jumbo mortgages are for home loans greater than $832,750.

- Super jumbo mortgages are for home loans greater than $1 million.

First-Time Home Buyer

Choose between a 30-year fixed rate or a 5/1 adjustable-rate mortgage.

Who's it for: Home buyers who have never owned a home or haven't owned a home in three or more years.

Features: Our first-time home buyer mortgage offers a special discounted rate, lower closing costs, and flexible down payment options.

Apply now.Other Mortgage Types

In some cases a traditional mortgage doesn’t meet your needs. We also offer mortgages for investment or rental property, second homes, and vacation homes. If you've ever dreamed of parking your plane at home, our hangar home loan is perfect for you.

For mortgage needs with special consideration, call us at (800) 533-0035, Option 3, or send us a contact request.

Apply now.While we do not offer FHA or VA loans, we encourage you to reach out to us as we do have options for members who have a down payment as little as 3.00%. View our rates for more details or call a mortgage specialist at (800) 533-0035, Option 3.

Our Rates^

-

APR as low as

5.448%

15-Year Fixed

Home Loans

-

APR as low as

6.075%

30-Year Fixed

Home Loans

-

APR as low as

6.085%

5/1 Arm (30-Year)

Home Loans

-

APR as low as

7.250%

5/10 Fixed

Owner Occupied HELOC

^Home Loan Rates and Information and HELOC Rates and Information

Rates Subject to Change. APR=Annual Percentage Rate. Rates Effective December 19, 2025. View Full Disclosures.

Our Rates^

-

APY as high as

1.87%

Savings

Share/IRA Accounts

-

APY as high as

4.05%

Short-Term Share Certificate

Share Certificate

-

APY as high as

4.00%

Share Certificate

Share/IRA Certificates

-

APY as high as

4.07%

Ladder Certificates

Share/IRA Certificates

-

APY as high as

0.40%

Priority Checking

Checking Accounts

-

APY as high as

0.25%

Flagship Checking

Checking Accounts

Rates Subject to Change. APY=Annual Percentage Yield. Rates Effective February 1, 2026.

Our Rates^

-

APR as low as

3.74%

New Auto

Up to 36 Months

-

APR as low as

4.24%

Used Auto

Up to 36 Months

-

APR as low as

4.49%

New Auto

Up to 60 months

-

APR as low as

4.99%

Used Auto

Up to 60 months

-

APR as low as

6.99%

RV

Vehicle Loans

-

APR as low as

6.74%

Boat/Airplane

Vehicle Loans

Rates Subject to Change. APR=Annual Percentage Rate. Rates Effective December 19, 2025.

Our Rates^

-

APR

14.25% - 16.25%

Signature Cash Back

Credit Cards

-

APR

12.00% - 17.74%

Platinum Rewards

Credit Cards

-

APR

10.50% - 18.00%

Platinum Low Rate

Credit Cards

-

APR

15.74%

Platinum Secured

Credit Cards

Rates Subject to Change. APR=Annual Percentage Rate. Rates Effective January 1, 2026.

Our Rates^

-

APY as high as

0.15%

Business Checking

Checking Accounts

-

APY as high as

0.40%

Business Savings Account

(Share) Savings Accounts

Rates Subject to Change. APY=Annual Percentage Yield. Rates Effective February 1, 2026.

Our Rates^

-

APR

12.24% - 18.00%

Platinum

Credit Cards

Rates Subject to Change. APR=Annual Percentage Rate. Rates Effective January 1, 2026.

Our Rates^

APR as low as

5.448%

15-Year Fixed

Home Loans

APR as low as

6.075%

30-Year Fixed

Home Loans

APR as low as

6.085%

5/1 Arm (30-Year)

Home Loans

APR as low as

7.250%

5/10 Fixed

Owner Occupied HELOC

^Home Loan Rates and Information and HELOC Rates and Information

Rates Subject to Change. APR=Annual Percentage Rate. Rates Effective December 19, 2025. View Full Disclosures.

APY as high as

1.87%

Savings

Share/IRA Accounts

APY as high as

4.05%

Short-Term Share Certificate

Share Certificate

APY as high as

4.00%

Share Certificate

Share/IRA Certificates

APY as high as

4.07%

Ladder Certificates

Share/IRA Certificates

APY as high as

0.40%

Priority Checking

Checking Accounts

APY as high as

0.25%

Flagship Checking

Checking Accounts

Rates Subject to Change. APY=Annual Percentage Yield. Rates Effective February 1, 2026.

APR as low as

3.74%

New Auto

Up to 36 Months

APR as low as

4.24%

Used Auto

Up to 36 Months

APR as low as

4.49%

New Auto

Up to 60 months

APR as low as

4.99%

Used Auto

Up to 60 months

APR as low as

6.99%

RV

Vehicle Loans

APR as low as

6.74%

Boat/Airplane

Vehicle Loans

Rates Subject to Change. APR=Annual Percentage Rate. Rates Effective December 19, 2025.

APR

14.25% - 16.25%

Signature Cash Back

Credit Cards

APR

12.00% - 17.74%

Platinum Rewards

Credit Cards

APR

10.50% - 18.00%

Platinum Low Rate

Credit Cards

APR

15.74%

Platinum Secured

Credit Cards

Rates Subject to Change. APR=Annual Percentage Rate. Rates Effective January 1, 2026.

APY as high as

0.15%

Business Checking

Checking Accounts

APY as high as

0.40%

Business Savings Account

(Share) Savings Accounts

Rates Subject to Change. APY=Annual Percentage Yield. Rates Effective February 1, 2026.

APR

12.24% - 18.00%

Platinum

Credit Cards

Rates Subject to Change. APR=Annual Percentage Rate. Rates Effective January 1, 2026.

Ready to get started?

Take the first steps toward home ownership today! Apply online or call (800) 533-0035, Option 3, to speak with a mortgage specialist.

Apply Now

Mortgage Features

- No application fee

- Free 60-day rate lock1

- Options including fixed- or adjustable-rate mortgage

- Low closing costs

- Ablility to pay points to "buy down" your initial mortgage rate

- No prepayment penalty

- Members on the Move - Earn cash back2 when you buy or sell a house with a program realtor. Talk to a Real Estate Coordinator today.

- In-house servicing so you can have peace of mind for the future of your mortgage

- Rate modification3 to take advantage of a lower rate in the future

- Yearly Bonus Dividend4 earnings based on the interest you've paid on your mortage

Connection Points powered by CURewards.®

* This is not a firm offer of credit or a guaranteed loan offer. An instant preapproval letter is only eligible on primary residences. Debt-to-Income (DTI) ratios must be under 33%/43% with a minimum credit score of 660. Any income listed aside from standard W2 wages will not be immediately eligible to receive a preapproval. Not all members will be eligible.

1 We offer a free 60-day rate lock on both purchase and refinance transactions and a free 90-day rate lock on construction-to-perm loans. All rate locks are valid for up to 60 or up to 90 days respectively from the date the Rate Lock Agreement is signed. Certain terms and restrictions apply. Contact a mortgage loan officer for full details

2 The cash back bonus is offered in most states. In some states, a gift card or commission reduction at closing may be provided in lieu of the cash back bonus. The program is only available for home purchase/sale in the contiguous U.S., Alaska and Hawaii, with the exception of Iowa. The program is not available for employer-sponsored relocations. The cash-back bonus is not available in Alaska and Oklahoma. In Kansas and Tennessee, a MAX Mastercard® gift card will be issued. In Mississippi, New Jersey, and Oregon, a commission reduction may be available at closing. The cash-back bonus is only available with the purchase and/or sale of your home through the use of a program-introduced real estate agent. The actual amount you receive is based on the purchase and/or sale price of your home. Customers are not required to receive financing from a particular lender in order to receive benefits of this program. The program award is not available in certain transactions with restricted or reduced agent commissions (including many new construction, For Sale by Owner, For Sale by iBuyer transactions or where a minimum transaction side commission is not paid). Your assigned agent or a real estate coordinator can help you identify any transactions where the award would not be available. All real estate commissions are negotiable. This is not a solicitation if you're already represented by a real estate broker. Please check with a program coordinator for details. Program terms and conditions are subject to change at any time without notice. Additional terms, conditions, and restrictions apply.

Mastercard is a trademark of Mastercard International Incorporated.

3 Not all loan programs are eligible. Must be a member in good standing. There are no principal payments in the month of modification. The fee schedule is subject to change without notice. The minimum fee for a modification is $500 with no maximum cap. Contact the Credit Union for more info.

4 Bonus dividends are not guaranteed.