Online Banking

Securely access your account 24/7 online or with our mobile app. You can transfer and move money, manage your account preferences as well as monitor your credit score and finances.

ENROLL NOW

Banking on the go

Download our mobile app♦ to access online banking anytime, anywhere.

Get our app on the App Store.®

Apple Watch is also supported.

Online Banking Services

Our online banking experience has the same look and feel regardless of which device you use to access it. Online banking allows you to check balances and transaction history, and also add cards to your digital wallet. You can locate nearby branches and ATMs as well as apply for a loan. Manage your cards and even track your credit score and report.

Our mobile app allows you to log in with biometric ID (depending on your smartphone) and also make mobile deposits.*

TIP: To enroll in online banking, use the nine-digit member number located in the upper right corner of your monthly account statement.

Enroll in Online Statements

Online banking statements include information on all of your financial products with the Credit Union with the exception of mortgages and credit cards. Not only are online statements better for the environment, they can benefit you, too! When it comes to tax time, you won’t have to wait to receive your tax forms in the mail.

1) In online banking, use the menu to select "Account Services."

2) Select "Statements & Notices" to sign-up and view your online statements.

Stay Connected

We have several ways of getting you the help you need and keeping you informed about your account activity.

Chat and Secure Messaging: Interact with an online banking member service representative during business or send a secure message for follow-up after hours.

Account Alerts: Customize your account alerts so you can be aware of any unusual activity, such as unauthorized transactions or when your balances are too low.

Activity Center: Schedule recurring transactions, approve transactions, review deposited checks, and more.

Enroll in Online Statements

Online banking statements include information on all of your financial products with the Credit Union with the exception of mortgages and credit cards. Not only are online statements better for the environment, they can benefit you, too! When it comes to tax time, you won’t have to wait to receive your tax forms in the mail.

1) In online banking, use the menu to select "Account Services."

2) Select "Statements & Notices" to sign-up and view your online statements.

Stay Connected

We have several ways of getting you the help you need and keeping you informed about your account activity.

Chat and Secure Messaging: Interact with an online banking member service representative during business or send a secure message for follow-up after hours.

Account Alerts: Customize your account alerts so you can be aware of any unusual activity, such as unauthorized transactions or when your balances are too low.

Activity Center: Schedule recurring transactions, approve transactions, review deposited checks, and more.

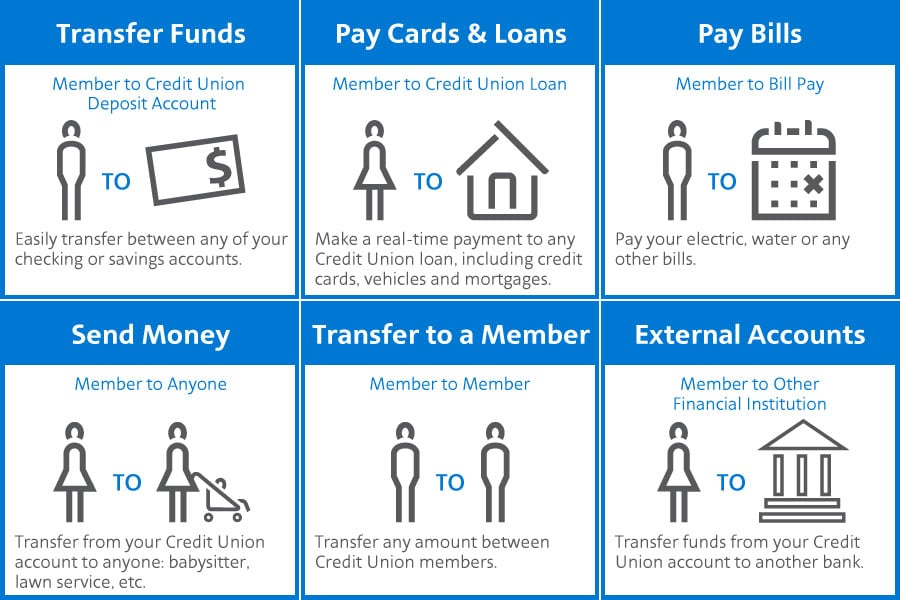

MOVE MONEY WITH EASE

We offer a number of ways to transfer funds and move your money depending on your banking needs.**

Transfer Funds – Move money between your Credit Union accounts.

Pay Cards & Loans – Make real-time payments to any Credit Union loan, including credit cards, vehicles and mortgages.

Pay Bills – Set up one-time or recurring payments for bills such as electric, water or other utilities.

Send Money – Transfer money from your Credit Union account to pay anyone (babysitter, lawn service, etc.)

Transfer to a Member – Transfer money from your account to other Credit Union members.

External Accounts – Easily move money between your accounts at other institutions and the Credit Union.

Wires - Securely send us domestic and international wire instructions for processing.

Manage My Cards

A variety of self-serve options are available to help you manage and access information about your credit and debit cards.

- Set up a travel notification.

- Temporarily turn cards on and off when misplaced.

- Report a card lost or stolen.

- Replace a damaged card.

- View card details.

- Add a card to your digital wallet.

- Manage overdraft protection options (debit only).

Credit Card Only

- Request a balance transfer.

- Request a credit limit increase.

- Add or remove authorized users.

Online banking provides additional features to help you on your financial journey.

Free Credit Score Montoring

There's more to your credit score. This service includes:

- Free access to your credit report and score

- Analysis of factors that impact your credit score

- Daily monitoring of key changes to your credit file

- Custom action plan, financial checkup and set goals to improve your score

- See personalized loan and account offers and apply

To get your free credit report and score:

- Log into your account through online banking or your mobile app.

- Click on "Financial Wellness" then "Credit Score and Report" to sign up today.

Budget & Spending HUB

Track your spending with a fully interactive, real-time updating dashboard that loads your Credit Union accounts along with additional accounts from other financial institutions. This tool includes:

- Personalized spending insights

- Colorful, easy-to-read charts

- Option to link external accounts for a complete financial picture

When you're logged into online banking, click on the "Get Started" button on the Budget & Spending Hub box at the top of your account dashboard.

The Navigator

We're here to assist you on your financial wellness journey. Our goal is to help you become fiscally fit by providing you with outstanding tools, resources and coaching. You’ll find all these and so much more on The Navigator,¹ your online, interactive web portal. Members enjoy unlimited access to The Navigator.

Once you have completed your profile, this will launch your financial wellness journey where you can explore the vast wealth of knowledge contained in this interactive, skill-building web tool. With this tool, you'll find:

- Personalized action plans

- Interactive courses

- Easy-to-use calculators and budgeting tools

- Live webinars

My Toolkit

This is your one-stop shop for financial apps. You can select from a set of third-party apps to help you run your business, create legal documents, and more – all in one convenient location.

Please note: Fees and qualifications vary by app.

Apps include:

- Autobooks Small business owners can simplify their books, manage cash flow and access the necessary reports.

- OneDigitalTrust Users of this estate- and inheritance-planning platform can create legal documents, including wills, living trusts, healthcare and financial powers of attorney and others.

- Trustworthy® Successful modern families can collaborate with loved ones and advisors to protect and organize their most important information. Secure items like family IDs, money, property, passwords, insurance, tax records, estate documents, contacts, and more – all in one place.

- TurboTax Individuals filing taxes can get 10% off with TurboTax.® With seasoned tax experts and powerful tech, TurboTax handles the details so you can be sure your taxes are done right.

To register: Use a browser to log into online banking and select “My Toolkit” to get started. Your My Toolkit apps can be managed through the Credit Union app after completing registration on a browser.

American Airlines Credit Union does not assume any responsibility or liability for any purchases or promotions made by a third party

Free Credit Score Montoring

There's more to your credit score. This service includes:

- Free access to your credit report and score

- Analysis of factors that impact your credit score

- Daily monitoring of key changes to your credit file

- Custom action plan, financial checkup and set goals to improve your score

- See personalized loan and account offers and apply

To get your free credit report and score:

- Log into your account through online banking or your mobile app.

- Click on "Financial Wellness" then "Credit Score and Report" to sign up today.

Budget & Spending HUB

Track your spending with a fully interactive, real-time updating dashboard that loads your Credit Union accounts along with additional accounts from other financial institutions. This tool includes:

- Personalized spending insights

- Colorful, easy-to-read charts

- Option to link external accounts for a complete financial picture

When you're logged into online banking, click on the "Get Started" button on the Budget & Spending Hub box at the top of your account dashboard.

The Navigator

We're here to assist you on your financial wellness journey. Our goal is to help you become fiscally fit by providing you with outstanding tools, resources and coaching. You’ll find all these and so much more on The Navigator,¹ your online, interactive web portal. Members enjoy unlimited access to The Navigator.

Once you have completed your profile, this will launch your financial wellness journey where you can explore the vast wealth of knowledge contained in this interactive, skill-building web tool. With this tool, you'll find:

- Personalized action plans

- Interactive courses

- Easy-to-use calculators and budgeting tools

- Live webinars

My Toolkit

This is your one-stop shop for financial apps. You can select from a set of third-party apps to help you run your business, create legal documents, and more – all in one convenient location.

Please note: Fees and qualifications vary by app.

Apps include:

- Autobooks Small business owners can simplify their books, manage cash flow and access the necessary reports.

- OneDigitalTrust Users of this estate- and inheritance-planning platform can create legal documents, including wills, living trusts, healthcare and financial powers of attorney and others.

- Trustworthy® Successful modern families can collaborate with loved ones and advisors to protect and organize their most important information. Secure items like family IDs, money, property, passwords, insurance, tax records, estate documents, contacts, and more – all in one place.

- TurboTax Individuals filing taxes can get 10% off with TurboTax.® With seasoned tax experts and powerful tech, TurboTax handles the details so you can be sure your taxes are done right.

To register: Use a browser to log into online banking and select “My Toolkit” to get started. Your My Toolkit apps can be managed through the Credit Union app after completing registration on a browser.

American Airlines Credit Union does not assume any responsibility or liability for any purchases or promotions made by a third party

Frequently Asked Questions

In online banking, open the "Settings" menu and select "My Profile" to update your personal information on your account.

In online banking, open the "Settings" menu and select "Security Preferences." From the options, select "Secure Access Code Options."

For mobile deposit, you'll need to ensure you have our mobile app. You can download it from the Apple App Store or the Google Play Store. Once you're logged in on the app, choose "Mobile Deposit" from the menu bar and follow the on-screen instructions.

In online banking, select "More" in the upper right corner and then select the "Activity Center." From there, select the "Checks" tab to see deposited check images. Use the filter option to refine your search results.

In online banking, select the "Manage My Cards" menu option and scroll down to select the card to set up the notifications.

Currently, Android 12.x has limited support with Android 13.x and later fully supported. For iOS 15.x and WatchOS 8.x, there is limited support, but iOS 16.x and later and WatchOS 9.x and later are fully supported.

You can view account balances and transaction history right from your watch. To turn it on, simply log into our mobile app and select “Apple Watch” under “Settings” in the menu.

♦ Message and data rates may apply. Check with your mobile provider.

* Mobile deposit is limited to members in good standing with an American Airlines Credit Union checking account.

** Fees may apply, refer to the Fee Schedule for details.

1 The Navigator is powered by Enrich

App Store and Apple Watch are trademarks of Apple Inc.

Google Play is a registered trademark of Google LLC.

Visa is a registered trademark of Visa International Service Association. The EMV® SRC payment icon, consisting of a pentagon design oriented on its side with a stylized depiction of a fast forward symbol on the right, formed by a continuous line, is a trademark owned by and used with permission of EMVCo, LLC.

Visit https://turbotax.intuit.com/lp/yoy/guarantees.jsp for TurboTax product guarantees and other important information. TurboTax is a registered trademark and/or service mark of Intuit Inc. in the United States and other countries.